You might be confused to think that this entry is about movies of SRK/KJ and company. Actually, there is one man whose fortune is following the same path as these movies.. After all there is a limit to which you can expect people to like nie tolerate non0sense.

Yes you guessed it right..

From an almost arrogant "मैं हू ना" a couple of years back, mr. PC is almost thinking "कल हो ना हो", and it won't be a surprise if his budget reflects those sentiments.

More about this later.

Tuesday, February 27, 2007

Sunday, February 25, 2007

HMTPL blues.....

Well really I couldn't hold myself from writing about this "Wonderful" (pun intended) movie I saw today, "HMTPL" Honeymoon Travels Pvt. Ltd. The only good part about the movie was I watched it with Sujay. You've to watch a movie with Sujay to understand what this really means.

The movie has got a lot of unique things - Story in short is - It's about a bunch of couples going to Goa for honeymoon.

So far so good - There is a "Superman/Superwoman couple. Who fight once only in 16 years (atleast they claim so....) and make feline and bovine sounds before making love. Didn't know that the supercreatures have to go to sub-human levels.. anyways." Then there is this girl who's always in dreams and she finds an oyster (of course made up of cotton and wool) and there is a pearl in that oyster that unfortunately looks like an Dinausaurus Egg from Jurassic Park (ok thats' Sujay's idea not mine). Then there's a guy who's Gay (which he knows. already) but still marries a poor girl who's been ditched already, and the husband of the dreamer girl (yeah the same Jurasic Park Pearl one) who apparantly is attracted towards the Gay guy.. Hello, Are you still with me? Yes all of this is there in one movie...... And I sat for two hours watching this and being tortured...

Worst part of it all was - I was surrounded by too many members of fairer sex around, so couldn' t use my usual abusive impolite language while making comments about the movie and was reprimanded for disturbing by an elderly lady... (Actually I know what put her off.. But Let's leave that..)

The movie has got a lot of unique things - Story in short is - It's about a bunch of couples going to Goa for honeymoon.

So far so good - There is a "Superman/Superwoman couple. Who fight once only in 16 years (atleast they claim so....) and make feline and bovine sounds before making love. Didn't know that the supercreatures have to go to sub-human levels.. anyways." Then there is this girl who's always in dreams and she finds an oyster (of course made up of cotton and wool) and there is a pearl in that oyster that unfortunately looks like an Dinausaurus Egg from Jurassic Park (ok thats' Sujay's idea not mine). Then there's a guy who's Gay (which he knows. already) but still marries a poor girl who's been ditched already, and the husband of the dreamer girl (yeah the same Jurasic Park Pearl one) who apparantly is attracted towards the Gay guy.. Hello, Are you still with me? Yes all of this is there in one movie...... And I sat for two hours watching this and being tortured...

Worst part of it all was - I was surrounded by too many members of fairer sex around, so couldn' t use my usual abusive impolite language while making comments about the movie and was reprimanded for disturbing by an elderly lady... (Actually I know what put her off.. But Let's leave that..)

Wednesday, February 21, 2007

A freakonomics Solution to Pune's Traffic Woes

Driving on Pune's roads is an ordeal one has to go through, and for a few unfortunate souls its a daily affair. There are a number of problems - One biggest being "When to stop at a signal and when not to?" For instance one would often find people going ahead on a red signal. Though it is universally accepted that Red signal is a stop sign, you'd often find people not giving a damn about it. If you happen to be an unfortunate one who believes that one should stop at the Red signal, you'd be horrified by the persistant honking that follows. The things become so worse, that eventually they are completely out of phase ie. you'd find vehicles forced to stop on Green Signal and others just continueing to go as if it's a big deal.

Here's a slightly toned down version of what the problem looks like. (Source is punepolice.com)

The question is how to solve this problem? You'd hear cries about - What if we "educate" the people that "Following Traffic Rules" is in your interest? Now I am not personally convinced of efficacy of any such mechanism. So Let's ask this question from a different view "What really causes people to break the traffic rules?" Possible reasons are

- They never believed that they were meant to be followed

- There is no benefit that they get by following traffic rules

- or They know that they can remain anonymous while continuing to do so.

Which means - there is not enough incentive to follow the traffic rules nor there are enough deterrents to stop breaking. So let's disturb this cost-to-benefit equation a bit. Obviously, you cannot offer benefits. So can you put more deterrents? Possibly yes.

How do we go about doing this? There is a solution to this problem, which unfotunately is a bit expensive, but with a little bit of efforts (and sacrifice in terms of advertisement revenues) from Local News Papers and co-operation from Pune RTO, can be achieved. Infact, this solution might actually generate a few part-time jobs (or other incentives can be thought out.). The solution is as follows - You deploy a bunch of young kids on each of the traffic signals and ask them to perform only a simple task. Whenever they find a vehicle breaking the rules, they simply note down the number of that vehicle and thats it and around 8pm everyday they submit the list of all such vehicles to one central place (say a Newspapers' office.) The newspapers office then with the help of RTO, figures out the owner's of the registered vehicles and publishes a database of 1000 offenders every day on the front page of their Local Version of Newspaper (most of them have eg. Pune Times, Pune blah blah etc.) The format should be as follows -

- Vehicle name

- Vehicle's Owner

- Number of offenses.

With Font sizes becoming bigger and bigger when number of offenses increases.

What this would actually result in - No one can remain anonymous breaking signals and one is bound to feel embarrased, when one's pal point out his name in the newspaper. Imagine if you are "behind some girl and she figuring out your name in a newspaper? Gosh that alone can be the single biggest deterrent."

I firmly believe this would alleviate the problem to a great extent and eventually it will be solved.

Possible problems - How do you guarantee that the kids will really stop at the signal and not write fake numbers? (I guess one can write a program, to figure out fake entries, eventually, but for the time being lets accept that we live with this limitation.) Imagine offering right incentives to people eg. Their name published in a newspaper for doing this noble job?

Other possible outcomes - There will be a unique data available about the vehicles, which might throw in light on something else we have never thought about yet? eg. You may find a certain number of Honda Activa's registered during so and so time period. That's just one example. Now imagine what you can do with that data? Possibilities are limitless.

Happy Driving...... :-)

Anyone interested in "funding" this project, drop a comment!

Here's a slightly toned down version of what the problem looks like. (Source is punepolice.com)

The question is how to solve this problem? You'd hear cries about - What if we "educate" the people that "Following Traffic Rules" is in your interest? Now I am not personally convinced of efficacy of any such mechanism. So Let's ask this question from a different view "What really causes people to break the traffic rules?" Possible reasons are

- They never believed that they were meant to be followed

- There is no benefit that they get by following traffic rules

- or They know that they can remain anonymous while continuing to do so.

Which means - there is not enough incentive to follow the traffic rules nor there are enough deterrents to stop breaking. So let's disturb this cost-to-benefit equation a bit. Obviously, you cannot offer benefits. So can you put more deterrents? Possibly yes.

How do we go about doing this? There is a solution to this problem, which unfotunately is a bit expensive, but with a little bit of efforts (and sacrifice in terms of advertisement revenues) from Local News Papers and co-operation from Pune RTO, can be achieved. Infact, this solution might actually generate a few part-time jobs (or other incentives can be thought out.). The solution is as follows - You deploy a bunch of young kids on each of the traffic signals and ask them to perform only a simple task. Whenever they find a vehicle breaking the rules, they simply note down the number of that vehicle and thats it and around 8pm everyday they submit the list of all such vehicles to one central place (say a Newspapers' office.) The newspapers office then with the help of RTO, figures out the owner's of the registered vehicles and publishes a database of 1000 offenders every day on the front page of their Local Version of Newspaper (most of them have eg. Pune Times, Pune blah blah etc.) The format should be as follows -

- Vehicle name

- Vehicle's Owner

- Number of offenses.

With Font sizes becoming bigger and bigger when number of offenses increases.

What this would actually result in - No one can remain anonymous breaking signals and one is bound to feel embarrased, when one's pal point out his name in the newspaper. Imagine if you are "behind some girl and she figuring out your name in a newspaper? Gosh that alone can be the single biggest deterrent."

I firmly believe this would alleviate the problem to a great extent and eventually it will be solved.

Possible problems - How do you guarantee that the kids will really stop at the signal and not write fake numbers? (I guess one can write a program, to figure out fake entries, eventually, but for the time being lets accept that we live with this limitation.) Imagine offering right incentives to people eg. Their name published in a newspaper for doing this noble job?

Other possible outcomes - There will be a unique data available about the vehicles, which might throw in light on something else we have never thought about yet? eg. You may find a certain number of Honda Activa's registered during so and so time period. That's just one example. Now imagine what you can do with that data? Possibilities are limitless.

Happy Driving...... :-)

Anyone interested in "funding" this project, drop a comment!

Saturday, February 17, 2007

No More Cruise Control, Wear Your Seat Belts.

The latest issue of Economist has got a very interesting cover. It's showing a Tiger with his tail on fire. If I'd have it my own way, I'd rather Have P Chidambaram with his "lungi" on fire. I know it is politically incorrect, so I'd refrain.

Last time when Mr. PC announced the budget, there was a headline which I still remember "PC leaves the Economy on Cruise Control." Unfortunately, the same economy has found the turbulance of rising inflation, current account deficit and Mr. PC has to infact make an announcement to the effect "Krupaya Kursi ki Peti Baandh leejiye.. (Please wear your seat belts.)"

Meanwhile, in hindsight there are a number of things that could have been done - If the local fuel prices did actually follow the crude prices, initially, this would have helped to curb inflation a bit.

The credit flow (in the form of housing mortgage) should have been checked.

The government who shouts from the rooftops about being pro-poor, pro-farmer should answer why farming output growth over las t year has actually slowed down? Sharad Pawar, there is more to life than Cricket and BCCI.

What happened to the 2pc that you take Mr. PC over and above our Tax that is supposed to be going to Education? I don't see any new schools coming up, except the lamentable debate about the Reservations in premier institutes?

But then here's a Finance Minister busy making comments about "Stock Markets" while leaving the economy on Cruise Control. It will be interesting to see what actions Mr. PC takes to find a way out of turbulance.

Last time when Mr. PC announced the budget, there was a headline which I still remember "PC leaves the Economy on Cruise Control." Unfortunately, the same economy has found the turbulance of rising inflation, current account deficit and Mr. PC has to infact make an announcement to the effect "Krupaya Kursi ki Peti Baandh leejiye.. (Please wear your seat belts.)"

Meanwhile, in hindsight there are a number of things that could have been done - If the local fuel prices did actually follow the crude prices, initially, this would have helped to curb inflation a bit.

The credit flow (in the form of housing mortgage) should have been checked.

The government who shouts from the rooftops about being pro-poor, pro-farmer should answer why farming output growth over las t year has actually slowed down? Sharad Pawar, there is more to life than Cricket and BCCI.

What happened to the 2pc that you take Mr. PC over and above our Tax that is supposed to be going to Education? I don't see any new schools coming up, except the lamentable debate about the Reservations in premier institutes?

But then here's a Finance Minister busy making comments about "Stock Markets" while leaving the economy on Cruise Control. It will be interesting to see what actions Mr. PC takes to find a way out of turbulance.

Friday, February 16, 2007

Withdrawal Symptoms

Didn't know that they have NSE closed on account of "Mahashivaraatri"...

Welcome to the country of 10 odd religions, 20 odd languages, 100 odd dialects and 200 odd public holidays in a year!!!

Welcome to the country of 10 odd religions, 20 odd languages, 100 odd dialects and 200 odd public holidays in a year!!!

Wednesday, February 14, 2007

Google Messes it Up...

Remember those cool images at the top on the main google page that you get when you open google. I always liked those images, were neat, witty and simple. I was just wondering, lets check what google has done for the Valentines day. Expected something cool.. But the google image was a great disappointment. It is so "un-google-like". Check below for the image.

The image is more like "googe" than google.. Just making two hearts of the two "O"s would have been just good.

Note Image is copyright "google" and so on usual legal yada-yada-yada.

The image is more like "googe" than google.. Just making two hearts of the two "O"s would have been just good.

Note Image is copyright "google" and so on usual legal yada-yada-yada.

Tuesday, February 13, 2007

Moore's Law Trivia.

On my recent visit to Santa Clara, I had a rather boring saturday afternoon, and was just wondering what to do, so I asked Suman, can you suggest some official "lukkhagiri"? Suman, being prompt as ever, suggested why don't you go somewhere? LA was out of question, too far away for just one guy to be driving, so suman goes to wikitravel and suggests visiting Intel museum. Not at all a bad idea for a boring saturday afternoon and that was just a mile away. It's one cool place to visit once if you are a bit techiesh. Of the several things on display there, what I liked was some trivia about Moore's Law.

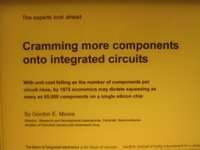

The pictures besides is the picture of the original paper written by Gordon Moore.

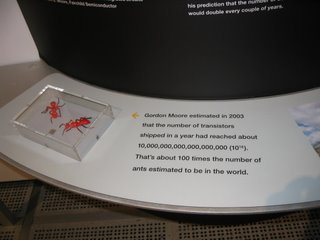

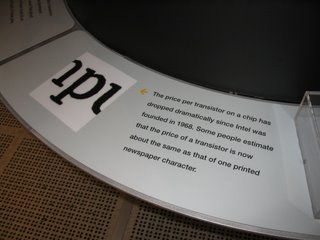

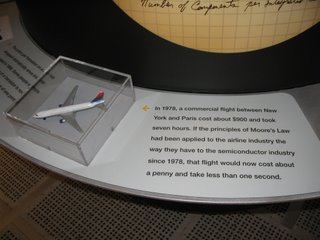

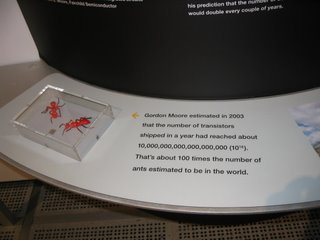

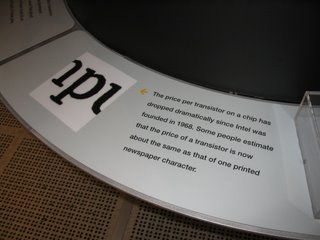

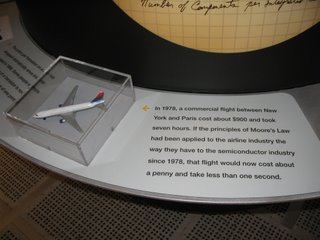

And the next three pictures are some intersting "trivia" about the Moores' law. The one I liked the most was about the number of ants!!

All the pictures above are from Intel Technology Museum (or whatever is the official name is... Hope you get the drift)

The pictures besides is the picture of the original paper written by Gordon Moore.

And the next three pictures are some intersting "trivia" about the Moores' law. The one I liked the most was about the number of ants!!

All the pictures above are from Intel Technology Museum (or whatever is the official name is... Hope you get the drift)

Deciphering Futures Open Interest (OI).

Open Interests in futures contracts has always puzzled me, what it means when open interests are reducing with decreasing price? or reducing with increasing price? A rather common answer to this is that open interest should increase in the direction of price movement implying if the price increases the open interest should increase. Actually a lot is happening underneath, which is not so obviously clear. So I started with an example. Here is the deal -

Lets say at the end of yesterday OI was 100 and futures were trading at the same price as that of the underlying, say Nifty at 4100. Now at the end of today Nifty is trading at 4050 and futures are trading at 4045, but the open interest at the end of the day was 80. What this implies is ->

There are more "new sellers" joining in than the buyers (futures started trading at discount). Lets say 30 new sellers come to the market and 20 new buyers come to the market. So Assuming no one squared off their position, we should have an increase in open interest of 20 (each new buyer bought from a new seller), but we still have 10 sellers who have to find out 10 buyers. Where do they come from? Obviously original sellers have to square of their positions. So the net result is as follows No original buyers squared off their positions, 10 original sellers squared off their positions. This indicates a possible build up in "short" positions (sellers are more agressive and some week hands got out.) Chances are that selling will continue.

But lets say open interest actually reduces to 80. What this indicates is atleast 50 sellers got out of the market and 40 buyers got out of the market (assuming 20 new buyers joined the market). This is an indication of "shorts squared off", more than the longs, indicating this was just profit booking and no net new sell-offs.

Now lets assume that at the end of the day nifty was still down to 4050, but the futures were trading at 4055, (premium). This means there are more "new buyers" than "new sellers". Assuming that the open interest increased by 10 and lets say there are 30 new buyers and 20 new sellers. So what happened is 10 original sellers squared off their positions, but 20 buyers squared off their position. Possibly indicating that weak hands are getting out of the market, we need to keep watching for the next day.

But if open interest actually reduced by 10 say. This means 40 buyers squared off their positions and 30 sellers squared off their position. Implying buyers are less comfortable remaining in market, watch out.

These examples are just for understanding and inference that I have drawn from them is completely personal, no claims about being right.

Actually there is a lot more to this than end-of-day figures. Typically OIs during trading ours is a bit different than end of the day and intra day variations imply a lot more at what level buying is happening and what levels selling is happening.

(While I wrote this further selling in Nifty continued, so I am puzzled again!!)

Lets say at the end of yesterday OI was 100 and futures were trading at the same price as that of the underlying, say Nifty at 4100. Now at the end of today Nifty is trading at 4050 and futures are trading at 4045, but the open interest at the end of the day was 80. What this implies is ->

There are more "new sellers" joining in than the buyers (futures started trading at discount). Lets say 30 new sellers come to the market and 20 new buyers come to the market. So Assuming no one squared off their position, we should have an increase in open interest of 20 (each new buyer bought from a new seller), but we still have 10 sellers who have to find out 10 buyers. Where do they come from? Obviously original sellers have to square of their positions. So the net result is as follows No original buyers squared off their positions, 10 original sellers squared off their positions. This indicates a possible build up in "short" positions (sellers are more agressive and some week hands got out.) Chances are that selling will continue.

But lets say open interest actually reduces to 80. What this indicates is atleast 50 sellers got out of the market and 40 buyers got out of the market (assuming 20 new buyers joined the market). This is an indication of "shorts squared off", more than the longs, indicating this was just profit booking and no net new sell-offs.

Now lets assume that at the end of the day nifty was still down to 4050, but the futures were trading at 4055, (premium). This means there are more "new buyers" than "new sellers". Assuming that the open interest increased by 10 and lets say there are 30 new buyers and 20 new sellers. So what happened is 10 original sellers squared off their positions, but 20 buyers squared off their position. Possibly indicating that weak hands are getting out of the market, we need to keep watching for the next day.

But if open interest actually reduced by 10 say. This means 40 buyers squared off their positions and 30 sellers squared off their position. Implying buyers are less comfortable remaining in market, watch out.

These examples are just for understanding and inference that I have drawn from them is completely personal, no claims about being right.

Actually there is a lot more to this than end-of-day figures. Typically OIs during trading ours is a bit different than end of the day and intra day variations imply a lot more at what level buying is happening and what levels selling is happening.

(While I wrote this further selling in Nifty continued, so I am puzzled again!!)

Sunday, February 04, 2007

Flash Flex et al.

For a long time I wanted to develop a web based charting tool for the stock quotes at NSE. No google and yahoo charts don't come closer to what I have in mind. Basically what what I want to do is to have a good version of candle-stick charts for stocks and futures traded on NSE.

Choices I made -> Flash/Flex (without having a clue what it is!!) No java, there are some java based charts indiabulls has one, decent but not close to what I want. NSE official website also has one but no candle-stick.

So after deciding flex or flash it is, I started basing things googling about it. Frankly, I got thoroughly confused over what the heck is this all about? Plus I need some opensource, free (as in beer would do!) tools, just don't have the money to pay to Adobe.

So, First things first -> what is Flash? What is Flex? What is Flex2? What is ActionScript 3.0? Gosh.... luckily I found a nice blog entry which discusses basic things that I wanted to have answers for. So far so good.

Finally I thought (and it may turn out I am completely wrong) that Flex 2 SDK from Adobe, which is free could be what I need?

Thats where I stand as of now. More about this later.

Ok, After spending some more time with the Flex 2 SDK and Flex Charting Tool Sample Applications, I think this is what I really wanted. Next step is download some data, write down some code and build my Demo Stock Charts Application..

More about this Later.

Choices I made -> Flash/Flex (without having a clue what it is!!) No java, there are some java based charts indiabulls has one, decent but not close to what I want. NSE official website also has one but no candle-stick.

So after deciding flex or flash it is, I started basing things googling about it. Frankly, I got thoroughly confused over what the heck is this all about? Plus I need some opensource, free (as in beer would do!) tools, just don't have the money to pay to Adobe.

So, First things first -> what is Flash? What is Flex? What is Flex2? What is ActionScript 3.0? Gosh.... luckily I found a nice blog entry which discusses basic things that I wanted to have answers for. So far so good.

Finally I thought (and it may turn out I am completely wrong) that Flex 2 SDK from Adobe, which is free could be what I need?

Thats where I stand as of now. More about this later.

Ok, After spending some more time with the Flex 2 SDK and Flex Charting Tool Sample Applications, I think this is what I really wanted. Next step is download some data, write down some code and build my Demo Stock Charts Application..

More about this Later.

Saturday, February 03, 2007

My notes on Whats happening on NSE

It has been while, I have been thinking a while about jotting down notes about what I think about whats happening in stock markets. First its a good idea to document what you observe, second someone other than me actually care to take a look at it. Generally, I want to end up making more educated guesses and do better trading eventually. Hope so atleast!!!!

Subscribe to:

Posts (Atom)